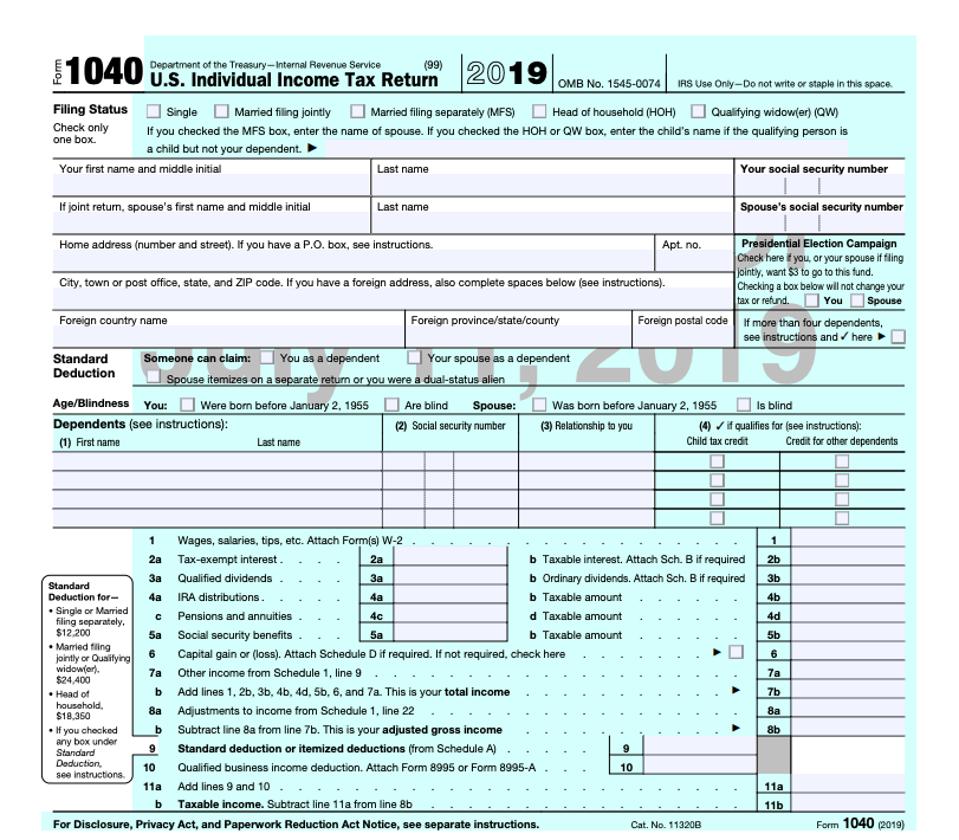

Just six (or so) months after the Internal Revenue Service (IRS) released the much talked about – and maligned – form 1040 for the 2018 tax year, there’s a new draft in town. Here’s a quick peek at the latest version, intended for the 2019 tax year:

IRS draft 2019 p1

IRS

IRS draft 2019 p2

IRS

Still determined to inspire tax professionals to kick their copy machines, the first page of the form 1040 doesn’t fill the page. Instead, as last time, it takes up just 2/3 of the page. It just feels like a Congressional compromise: still bigger than the promised postcard, but smaller than a standard size piece of paper.

Why did the form grow? There’s a good reason. The income reconciliation schedule – the bit where you summarize your income from the various forms and schedules – has been returned to the front page. (That sound you hear is tax pros cheering.)

So what else has changed? Here’s how the current and draft forms are alike and how they differ:

- Names and Social Security Numbers. The spaces for names and Social Security numbers remain largely the same.

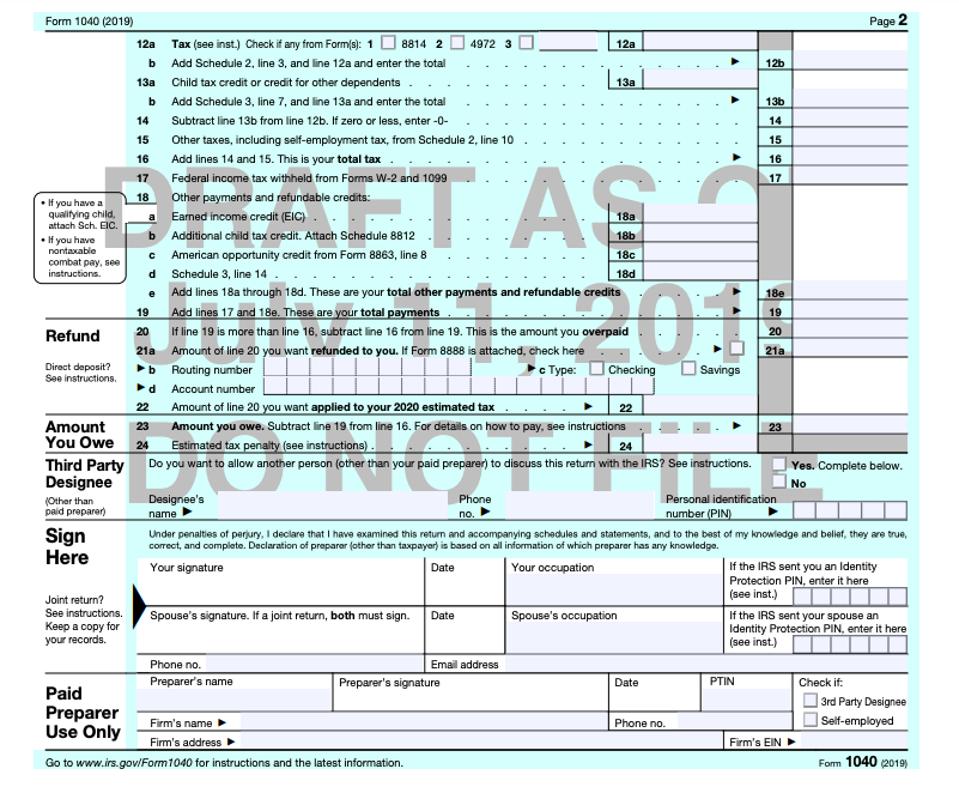

- Signatures. The spaces for signatures have moved to page two. This was an issue with the revised form 1040 in 2018, since many tax preparers didn’t love having a full page of figures without a signature fearing it could lead to fraud or other problems.

- Filing Status. You can still choose one of five filing statuses: Single, Married filing jointly, Married filing separately, Head of household, or Qualifying widow(er). However, there’s now a space for you to enter the name of your spouse if you checked the MFS box and your child’s name if you checked the HOH or QW box when the qualifying person is a child but not your dependent. My guess is that the lack of this information on the 2018 form made processing and form matching more difficult.

- Presidential election campaign. The option to contribute to the Presidential election campaign remains the same (you can read more about that here). The explanation which accompanies the checkbox has been restored.

- Health care coverage. Since health care coverage is no longer mandatory for the 2019 tax year, that checkbox has been removed.

- Dependents. The spaces for dependents appear the same.

- Income reporting. As noted earlier, the income reconciliation (that block on the front page where you used to transfer your items of income from separate schedules) has been moved back to the first page of the return. You’ll likely also notice that Schedule D (Capital Gains) is once again on the reconciliation schedule (it disappeared in 2018).

- Adjusted income reporting. Printing presses still have work to do. What was previously line 37 (adjusted gross income, or AGI) became line 7 in 2018. It’s now line 8b; pay attention to this moving ahead since many other federal (and financial) forms ask for AGI by line number.

- Standard deduction. Your standard deduction amounts have moved back to page one.

- Qualified business deduction. The qualified business deduction still has a spot on page one with a note to attach form 8995 or form 8995-A.

- Tax credits. The previous version of form 1040 consolidated the spaces for several tax credits into a line or two. Apparently, that proved confusing for taxpayers because separate lines for certain credits, like the Earned Income Credit (EIC) and the additional child tax credit have been returned to the form.

- Third Party Designee. The space that previously allowed you to designate another person to discuss this return with the IRS had been moved to a new Schedule 6 with a checkbox. That was confusing for taxpayers, and the Third Party Designee box is back on page two.

The result? Not counting new schedules, signature spaces and tick boxes, the new 1040 has just 24 lines – up just one from last year.

And remember those new, numbered schedules that were introduced last year? They’re still around, too, with some changes:

- The draft version of Schedule 1 (downloads as a PDF) looks largely the same – just a bit more tidy without all of those “reserved” lines. However, you will see another line item under alimony: you’re now required to provide the date of original divorce or separation agreement. That’s because, under the TCJA, alimony is not deductible under agreements signed on or after January 1, 2019. (For more on alimony, click here.)

- The draft version of Schedule 2 (downloads as a PDF) is a little bit longer. It appears that self-employment taxes, among others, have been moved from form 1040 main pages to this separate schedule.

- The draft version of Schedule 3 (downloads as a PDF) has likewise expanded. In 2018, schedule 3 was reserved for nonrefundable credits, like the foreign tax credits, but the draft version includes refundable and nonrefundable credits. (For more on nonrefundable credits, click here.)

- The draft version of Schedule 4 (downloads as a PDF) looks largely the same. Ditto for the draft version of Schedule 5 and Schedule 6 (each downloads as a PDF). In fact, they all still say 2018 – maybe more changes are on the way?

But, like last year, don’t hit print just yet. The IRS warns:

This is an early release draft of the 2019 IRS Form 1040, U.S. Individual Income Tax Return, which the IRS is providing for your information, review, and comment… Do not file draft forms. Also, do not rely on draft forms, instructions, and publications for filing. (emphasis added)

The IRS goes on to say:

We generally do not release drafts of forms until we believe we have incorporated all changes. However, in this case we anticipate it is likely that this draft will change at least slightly before being released as final. Whether we make changes to this draft or not, we will post a new draft later this summer with our standard coversheet (this page) indicating we do not expect that draft of the form to change. (emphasis added)

You can check out the draft form 1040 on the IRS website here (downloads as a PDF). If you have comments about the draft, you can submit those to [email protected] no later than August 15.

Nearly 90% of taxpayers are expected to use a tax preparer or file electronically, making the length of the tax form – and the placement of these changes – less impactful. However, it doesn’t escape notice that we appear to creeping back towards a version that looks more like 2017 than 2018.