Jordan Katzman, co-founder of SmileDirectClub Inc., left, and Alex Fenkell, co-founder of SmileDirectClub Inc., watch traders during the company’s initial public offering (IPO) at the Nasdaq MarketSite in New York, U.S., on Thursday, Sept. 12, 2019.

Michael Nagle | Bloomberg | Getty Images

Online dentistry company SmileDirectClub’s revenue climbed while its losses swelled in the company’s first earnings report as a public company.

Here’s what the company reported, compared with Wall Street estimates:

- Loss per share: 89 cents

- Revenue: $180.2 million vs. $165.4 million as forecast by Refinitiv consensus estimates

Given inconsistencies with outstanding share counts for a recently public company’s first quarterly report, CNBC does not compare earnings per share figures with EPS consensus estimates.

SmileDirectClub reported a third-quarter net loss of $387.6 million, or a loss of 89 cents per share. That includes a $299.3 million loss from SmileDirectClub’s non-controlling interest in SDC financial. The company posted a net loss of $14.95 million in the year-ago quarter.

Shares of SmileDirectClub rose by about 2% in after-hours trading Thursday.

“Post-IPO, our team is laser focused on execution,” SmileDirectClub Chief Financial Officer Kyle Wailes said in a statement. “Our results for the quarter, all of which exceeded management’s expectations, are a testament to the strength and momentum of the underlying business.”

For the full year, SmileDirectClub anticipates revenue of between $750 million and $755 million.

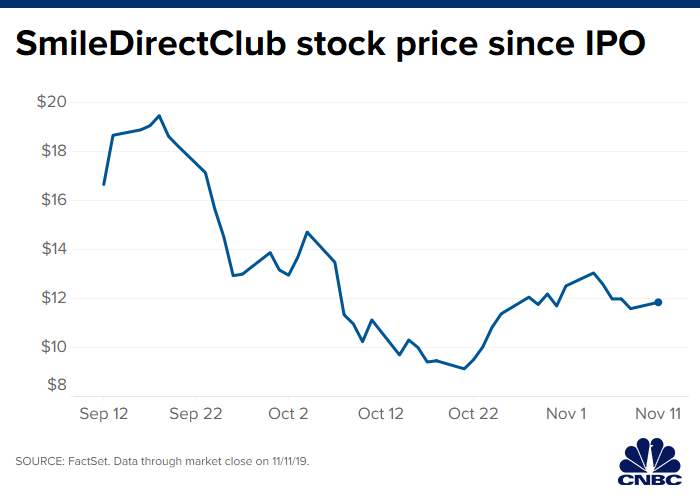

SmileDirectClub made its public debut in September. Shares slid 28% on its first day of trading, making it the worst initial public offering of the year for a so-called unicorn, or a start-up valued above $1 billion. SmileDirectClub’s shares are trading at around $11, well below its $23 per share IPO price.

The start-up, founded in 2014, sells teeth aligners directly to consumers on its website and in its “SmileShops” starting at $1,895 for a two-year plan. Founders Fenkell and Jordan Katzman say they want to disrupt the orthodontics industry with less expensive teeth-straightening treatments, convenience, and splashy television and social media advertisements.